S&OP planning is a month-long process aimed at addressing demand and supply imbalances. As a future-focused process, it is well positioned to address risks or disruptive events. We introduce the concept of Mini-S&OP to show how we can leverage the existing framework and run the S&OP process in an agile, condensed manner. A Mini-S&OP process is done within three to four days, to arrive at a collaborative, data-driven response strategy to a disruptive event. In the Mini-S&OP we leverage the existing decision-making structures and reporting apparatus to address a disruptive event.

Planning with black and white swans in mind.

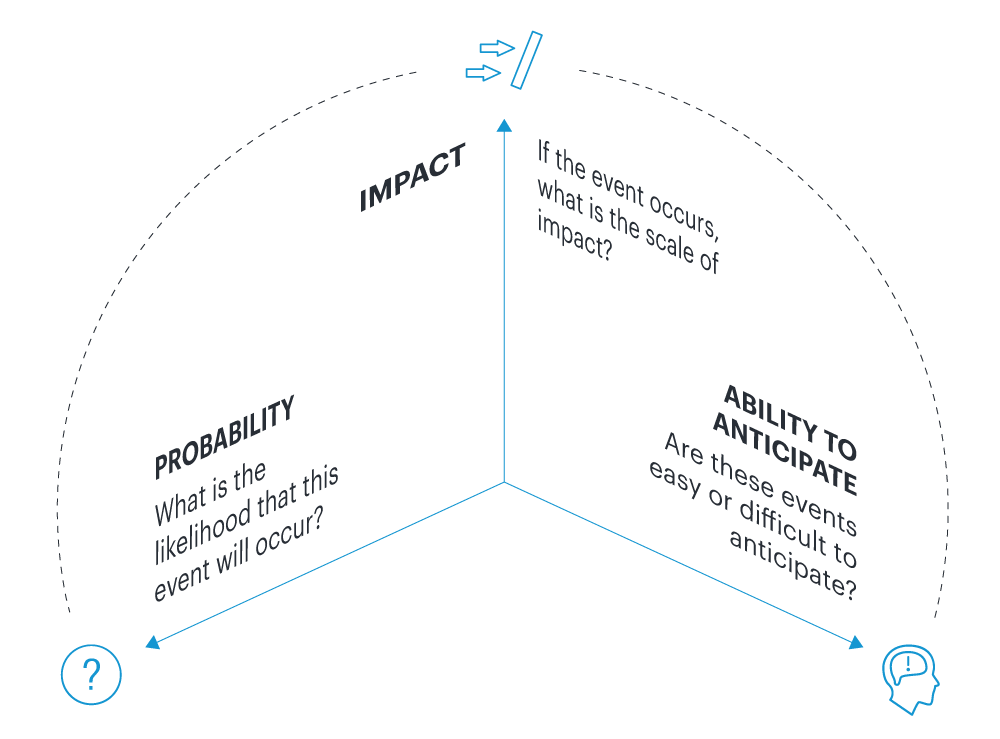

Sales and Operations Planning (S&OP) is a key supply chain planning process that aims to integrate different areas of business to meet customer demand with the appropriate supply over a four to 24-month horizon. Companies with mature S&OP processes are known to demonstrate improved coordination across business units, increased transparency, and to drive profitability. While S&OP is a monthly planning process focused on balancing demand and supply at a volume level, it has become imperative for us to start managing disruption as well within this framework. In an S&OP context, “disruption” is a broad word that can define any event that threatens a smooth flow of operations. So, to increase specificity, we need to define certain parameters by which we can classify disruptions.

Planning tools like SAP Integrated Business Planning provide us with state-of-the-art scenario planning capabilities that can help us model these disruptions. By doing so, we can arrive at the financial impact of these disruptions which will then facilitate the discussions around how we can plan for them. In the next blog, we shall see how we can leverage the S&OP platform to deal with risk management.

Share this article